Does Kier Starmer really believe raising taxes is the solution to the biggest issues in society?

By Colette Cairney

Downing Street (Image: Unsplash)

On Wednesday, Rachel Reeves, the first female chancellor of the United Kingdom, has introduced tax measures that are supposed to raise an additional £26.1bn in 2029-30.

Kier Starmer has defended Rachel Reeves actions. He said: “[It will] lift hundreds of thousands of children out of poverty.” Starmer had also said that child poverty is "abhorrent", and he is "absolutely determined to keep it down.”

As well as raising taxes, Reeves is determined to end the two-child benefit cap. In scrapping the cap, it is hoped that an estimate of 450,000-500,000 children will be lifted out of poverty. This new rate means hundreds of people will start paying higher amounts of tax as their pay-check increases.

In doing this Rachel Reeves has greatly benefited herself, she has now earned a second entry on the UK’s eight most tax rising budgets in the last 50 years.

Alongside this, Reeves has introduced a tax relief on working from home – expected to begin next year. This means people who are working from home will no longer be able to claim money back for domestic expenses, such as, gas, electric, water or business phone calls. This is expected to take place on the 6th of April next year.

As Reeves and Starmer claim raising taxes will be beneficial for all, First Minister John Swinney has disagreed with these claims. Today, during First Minister Question Time he said the Scottish government will not be introducing an increase on tax or introducing any new bands.

Swinney said: “The Scottish Government focus mainly on public policy investments and the need to support these investments without increasing the tax burden.”

John Swinney, First Minister (Image: Getty Images)

Starmer has been seen strongly defending the governments growth record. In an interview conducted by Chris Mason, Starmer pointed out the Office for Budget Responsibility (OBR) upgraded its 2025 forecast from 1% to 1.5%.

The OBR has gone on to explain that the growth was “Stronger than expected” in its first quarter of the year. It’s thought this is partly driven by the “temporary frontloading of property transactions and exports.”

BBC Scotland has released a few ways the introduction of the budget could affect anyone under the age of 25. The BBC said: “[This] benefit[s] minimum wage workers, as the hourly rate goes up in April, 2.7 million people will benefit from this increase.

“Student loan repayments have frozen from 2027-28, however people may be dragged into making larger repayments as thresholds will no longer be in line with inflation.

Lastly things like pre-packed milkshakes, coffee and online shopping will increase its prices, this is because of the chancellor’s decision to scrap a tax loophole on small parcels, and things with a higher sugar content will face higher tax rate from 2028, due to the ‘Sugar Tax’.”

The Conservative party and their leader Kemi Badenoch have opposed Starmer and Reeves actions. Badenoch said: “More people will be pushed into poverty because of the budget.

“The move was being funded by tax paying people, who are also struggling, but not on benefits.”

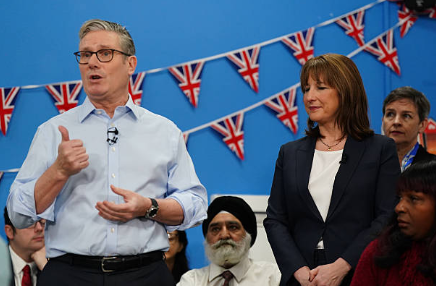

Kier Starmer and Rachel Reeves (Image: Getty Images)

Chris Mason reminded Starmer of his slogan ‘Country first, party second.’ And he questioned Starmer on whether the budget truly reflects this. Mason said: “Is the budget an attempt to keep MPs on the side of an ‘Unpopular leader’.”

Starmer said: “I have repeatedly said that I want my government to drive down child poverty.”

If given the choice most brits would oppose the idea of raising taxes, but 25% of people would support raising taxes by 1p.

As the next few months approach, it will become evident if Starmer has made a good decision in raising taxes or if he has just created more problems than solutions.